After several years of discussion between the Pharmacists’ Defence Association (PDA) and HMRC, the PDA was approved by the Commissioners for HM Revenue and Customs under Section 344 of the Income Tax (Earnings and Pensions) Act 2003 with effect from 6 April 2018.

In April 2021, the Pharmacists Defence Association was added to the list of professional association and learned societies of which members can reclaim all or part of their membership subscriptions. PDA members should be aware that printed or PDF versions of this list produced before April 2021 will not include the PDA, however this HMRC decision takes effect from the 2018-19 tax year.

How to calculate your claim

You can claim tax relief against the cost of your annual membership after deducting £15 which is deemed attributable to the PDA Union. The £10 membership fees for any PDA equality networks (the National Association of Women Pharmacists (NAWP), the LGBT+ Pharmacists Network, the BAME Pharmacists Network and the Ability Network for pharmacists with disabilities) which you may also have paid along with your membership are also not included in the scope of the HMRC decision.

To claim please:

- Confirm the amount of your annual membership fee, through these three steps:

- Go to https://www.the-pda.org/membership/

- Login and your payment information will be displayed

- To download and save this information, click on the “download PDF” button

- Ensure you have deducted the £15 from the annual membership fee from each year’s payment, before making your claim

- Ensure you are not claiming for the cost of being a member of any of the PDA Equality, Diversity & Inclusion networks

- Submit your claim using one of the methods explained below.

Please note that the full fee must still be paid in the normal way each year and that tax relief must be sought from HMRC after you have made your payment. You cannot deduct the tax relief from the amount you pay.

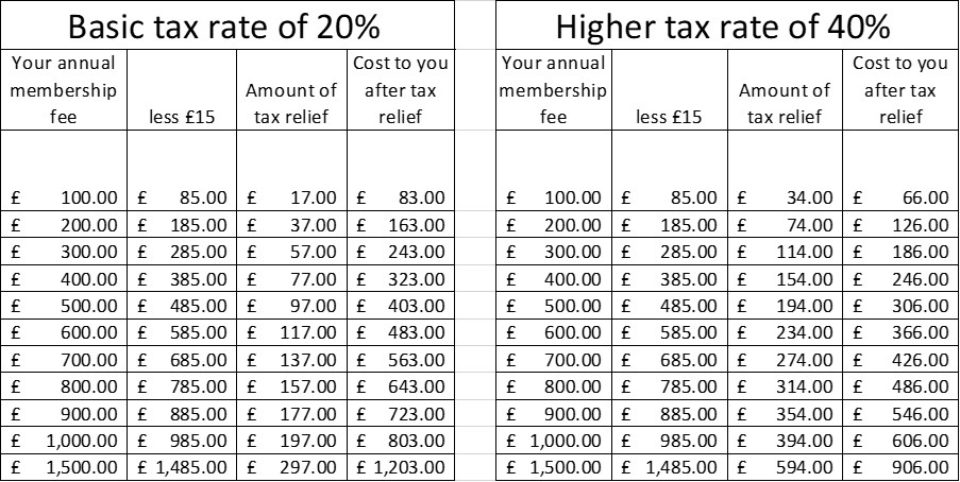

The impact of different tax rates

There is some variation in tax rates around the UK, however, for illustration purposes, the following tables show what this means for those on 20% or 40% tax rates:

How to claim

HMRC have advised it may take up until the end of May 2021 for all their systems to be updated with the inclusion of the PDA, in the meantime those who require immediate action can contact HMRC quoting the following reference number T164470319/TEM.

There are different ways of claiming the tax relief on your membership fees:

- If you have an accountant that advises on your tax affairs, you may ask them to give advice on the claim

- If you complete a self-assessment tax return, you can claim tax relief from your membership fees on the employment page of the return

- If you do not file a tax return, you can claim tax relief using form P87: Tax relief for expenses of employment

- HMRC processes are often updated, but at the time of writing, you can claim by telephone.

If you have already claimed expenses in a previous year and your total expenses are less than £2,500 for professional fees and subscriptions. To telephone HMRC and ask for relief on your fees, contact details can be found on the HMRC website.

Please also see the HMRC website for further details, including allowable expenses, eligibility, and claiming back tax for past years. The PDA cannot give you tax advice.

Retrospective claims

The HMRC decision takes effect from the 2018-19 tax year and therefore pharmacists who were already PDA members during previous tax years, and who have not already obtained tax relief against those payments, can claim retrospective relief against their membership fees for his tax year and the four previous tax years. Please remember to deduct £15 and the cost of any equality network membership fees from each year’s fee before you claim.

Not yet a PDA member?

If you have not yet joined the PDA, we encourage you to join today and encourage your colleagues to do the same.

Membership is FREE to pharmacy students, pre-regs and for the first three months of being provisionally registered/newly qualified.

Read about our key member benefits here.