In June, after listening to the views of thousands of Boots pharmacists, the PDA submitted the 2021 pay claim. The union believes the claim is well researched, evidence-based, realistic and reflects the views of the employees in the Bargaining Unit. Fundamentally it signals the very clear message received from pharmacists at Boots that they believe it is time for an increase that begins to restore the purchasing power of their income, back to at least 2015 levels.

The economic analysis within the claim included comparisons of the level of increase awarded to any pharmacist classified as “performing”, who was already being paid the so-called “market rate” for the job, vs. inflation. The “market rate” is a figure calculated by the company for each job to be equivalent to the (median) average salary paid to pharmacists for that role by other employers. Boots salary ranges are then set at 80-120% of that figure.

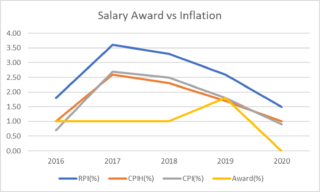

History of recent Boots pay awards vs. price inflation:

| Year | 2016 | 2017 | 2018 | 2019 | 2020 |

| RPI(%) | 1.80 | 3.60 | 3.30 | 2.60 | 1.50 |

| CPIH(%) | 1.00 | 2.60 | 2.30 | 1.70 | 1.00 |

| CPI(%) | 0.70 | 2.70 | 2.50 | 1.80 | 0.90 |

| Boots Pay Award(%) | 1.00 | 1.00 | 1.00 | 1.80 | 0.00 |

As can be seen, over the last 5 years, only twice has the Boots salary increment for such a pharmacist exceeded any measure of inflation (CPI in 2016 and CPIH in 2019). The increment has been significantly below RPI every single year since 2016.

A significant proportion of Boots pharmacists tell the PDA that they are paid below-average salaries by the company, i.e. between 80-99% of the so-called market rate. Although some of these individuals may have had higher percentage increases in some years, many report that they still remain below the market median rate. The PDA has created a ready reckoner tool on the union website for such members to understand where their pay sits in the pay range. The union also included in the pay claim a requirement that pharmacists’ rewards are reviewed by their managers to discuss their individual circumstances.

Pay talks commenced in July and the PDA listened carefully to the management position, seeking to be flexible to reach an agreement acceptable to both sides. At no point in the months of negotiations has the above data, demonstrating the reduction in the value of pharmacists’ pay, been disputed by the company.

As an agreement was looking unlikely, in September the PDA Union negotiating team exchanged correspondence with Chief Executive, Sebastian James, who confirmed that the negotiating team led by the Stores Director – Pharmacy reported direct to him about the pay talks. Mr James also arranged for Chief Financial Officer, Michael Snape to join one of the negotiation meetings, where he confirmed that the Stores Director – Pharmacy, Anne Higgins, is the decision-maker with the necessary authority to decide the pay award for pharmacists.

After Boots pharmacists rejected a further sub-inflation increase of just 2% this year, the media reported that an official Boots spokesperson claimed that the pay offer was “substantial” and that “Over the course of the last five years, we have awarded overall pay rises to our pharmacists that have exceeded the consumer price index”.

The PDA dispute this claim by the company spokesperson and challenge Boots to correct this statement or alternatively put supporting data into the public domain so that pharmacists can see the facts for themselves. The union also calls upon the company to come to the Acas talks prepared to agree on a fair pay increase for all pharmacists that is above inflation and to start the process of reinstating the purchasing power of pharmacists’ salaries.

Related links

- PDA pay claim 2021

- Boots pay ready reckoner

- PDA Union members overwhelmingly reject Boots pay offer with 83% calling on the Union to refer the dispute to ACAS

- Media article reporting Boots’ spokesperson comments

- Walgreens Boots Alliance Reports Fiscal Year 2021 Earnings

Note: UK inflation indices

The UK uses several official indices to measure price inflation:

- RPI: the retail prices index

- CPI: the consumer prices index

- CPIH: the consumer prices index plus owner-occupiers’ housing costs

Price inflation refers to the increase in the price of goods and services over time and RPI, CPI and CPIH differ by which goods and services are included and the formula used to combine different prices. The main difference is that RPI includes mortgage interest payments, CPI takes no account of housing costs and CPIH includes housing costs but uses an approach called “rental equivalence”.

Not yet a PDA member?

If you have not yet joined the PDA, we encourage you to join today and ask your colleagues to do the same.

Membership is FREE to pharmacy students, trainee pharmacists and for the first three months of being provisionally registered/newly qualified.

Read about our key member benefits here.